Business Insurance in and around San Antonio

Calling all small business owners of San Antonio!

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

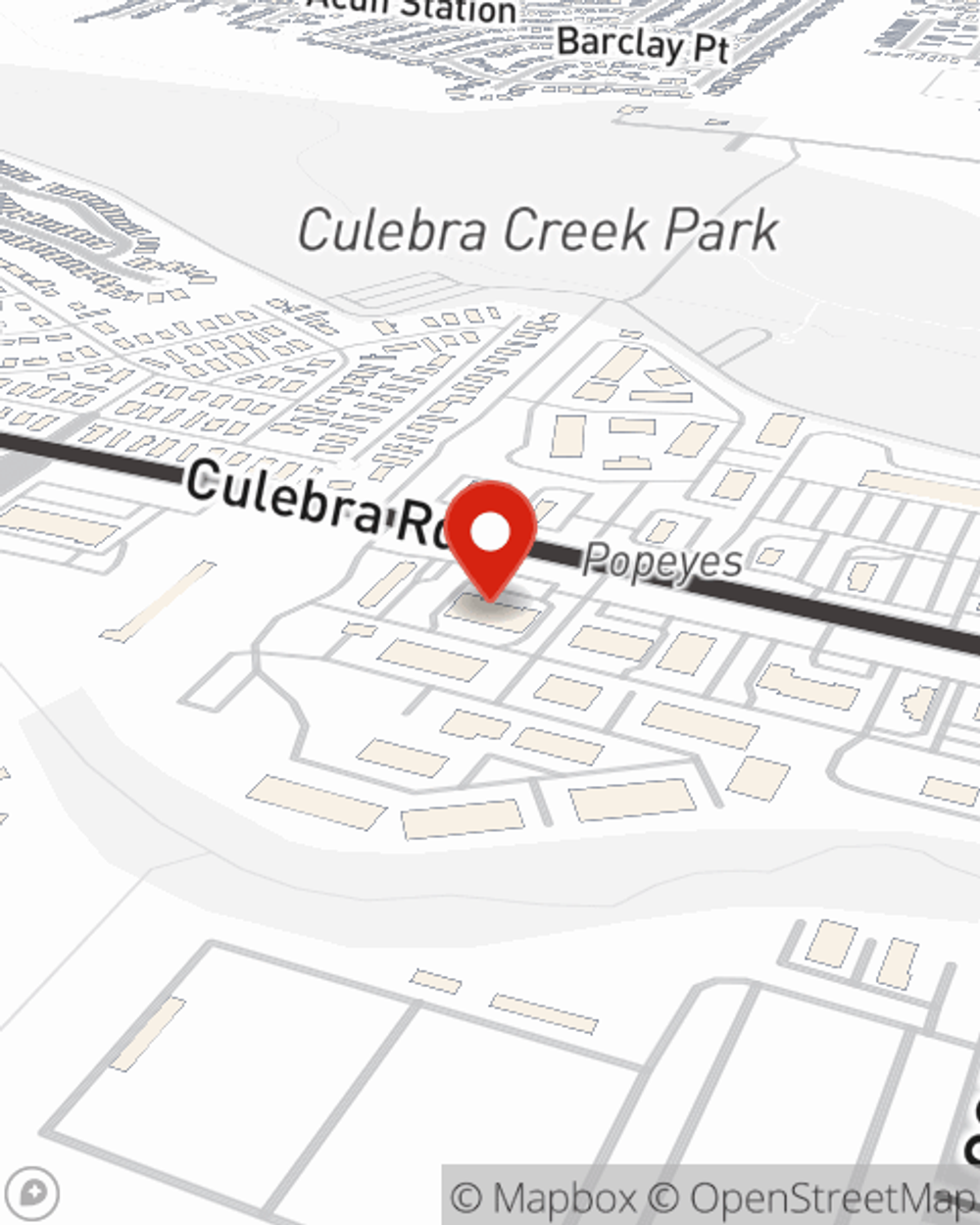

When you're a business owner, there's so much to remember. You're in good company. State Farm agent Sam Longoria is a business owner, too. Let Sam Longoria help you make sure that your business is properly covered. You won't regret it!

Calling all small business owners of San Antonio!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

For your small business, whether it's a tailoring service, an auto parts shop, a vet hospital, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like buildings you own, equipment breakdown, and accounts receivable.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Contact State Farm agent Sam Longoria's team today to discover your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Sam Longoria

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.