Condo Insurance in and around San Antonio

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Your Possessions Need Protection—and So Does Your Condo.

Because your condo is your retreat, there are some key details to consider - needed repairs, cosmetic fixes, neighborhood, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you quality coverage options to help meet your needs.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

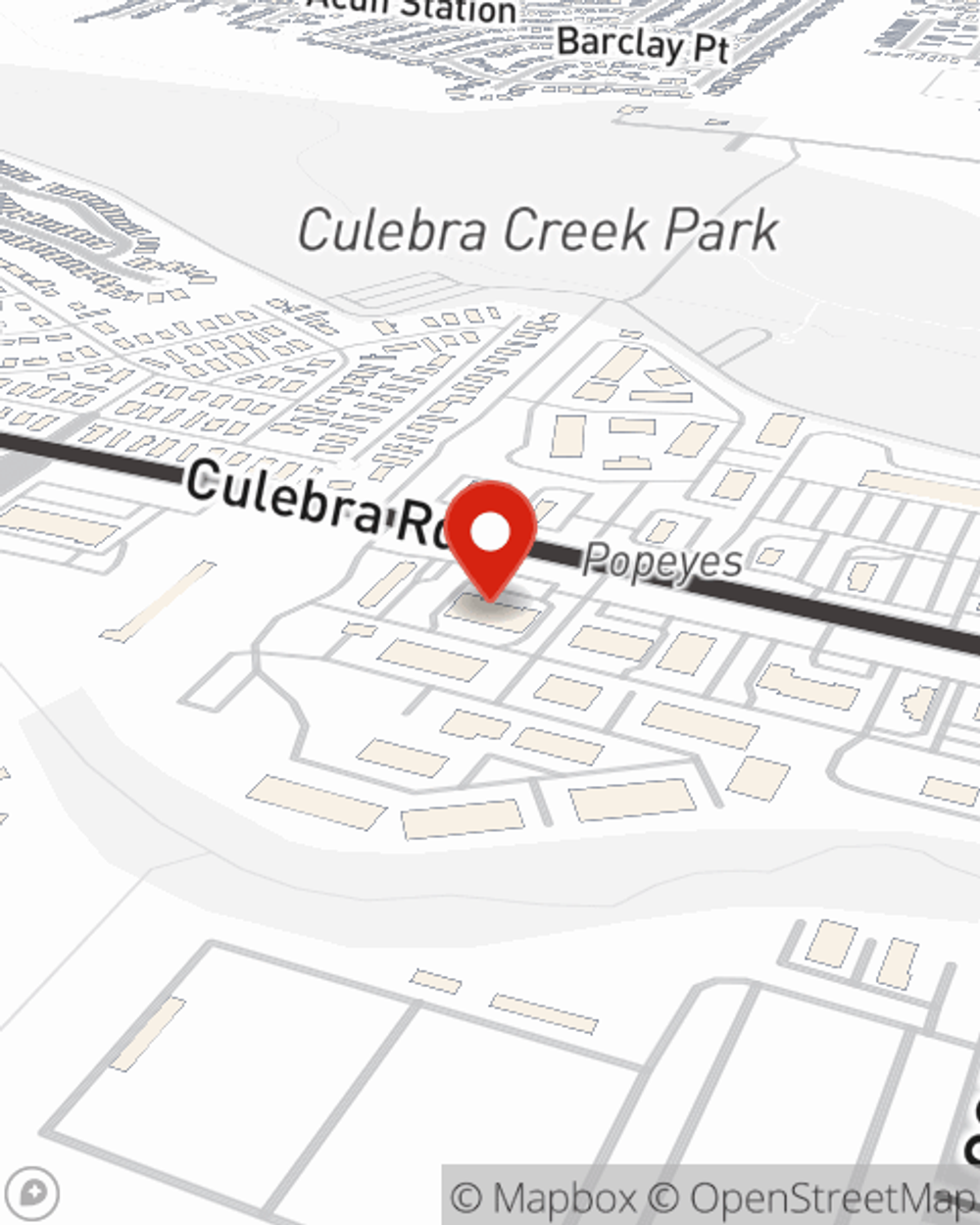

Agent Sam Longoria, At Your Service

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your condo and its contents protected. You’ll get coverage options to accommodate your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and terrific customer service, Agent Sam Longoria can walk you through every step to help create a policy that guards your condo unit and everything you’ve invested in.

Want to explore the State Farm insurance options that may be right for you and your unit? Simply call or email agent Sam Longoria's team today!

Have More Questions About Condo Unitowners Insurance?

Call Sam at (210) 433-3264 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Sam Longoria

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.